Introducing to Compound Interest

Compound interest, a term we hear frequently these days, but that few truly understand, is the key to multiplying wealth. Despite being a straightforward concept, many people still don’t grasp how it works.

There’s a famous quote attributed to Albert Einstein, one of the world’s greatest minds: “Compound interest is the eighth wonder of the world. Those who understand it, earn it; those who don’t, pay it.”

Although the origin of this quote is uncertain, it holds a lot of wisdom. In this article, you’ll discover why and understand the critical importance of it.

What Is It?

It is essential for any investor or anyone aiming to grow their money.

It involves calculating a percentage not just on the initial amount, but on the accumulated balance, which includes both the principal and previously earned interest.

For example, suppose you invest $1,000 in an account with a 5% annual return, compounded annually. This means the interest is applied to the accumulated balance each year.

Year-by-Year Calculation:

- Year 1:

- Initial Investment: $1,000

- Interest: 5% of $1,000 = $50

- Balance at the end of the year: $1,050

- Year 2:

- Starting Balance: $1,050

- Interest: 5% of $1,050 = $52.50

- Balance at the end of the year: $1,102.50

- Year 3:

- Starting Balance: $1,102.50

- Interest: 5% of $1,102.50 = $55.13

- Balance at the end of the year: $1,157.63

Note: Each year, the interest is calculated on the accumulated balance (initial amount + interest from previous years), creating a “interest on interest” effect. After 3 years, your initial $1,000 grows to $1,157.63, with the gains increasing each year due to the compounding effect.

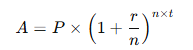

General Formula

The formula for calculating the final amount with compound interest is:

Where:

A is the final amount.

P is the principal or initial amount invested.

r is the annual interest rate (in decimal form).

n is the number of times interest is compounded per year.

t is the number of years.

This is the power of compound interest: the longer your money is invested, the more it grows due to the “interest on interest” effect.

What’s the Difference Between Simple and Compound Interest?

In investments, you can earn much more with they than with simple interest. Let’s explore the difference through a quick example.

Suppose you invest $1,000 at an interest rate of 5% per year for 3 years.

Simple Interest

With simple interest, interest is calculated only on the initial amount each year.

Formula:

Where:

J is the total interest,

P is the principal (initial amount),

r is the interest rate,

t is the time in years.

Calculation:

Interest: ( 1,000 x 0.05 x 3 = 150 )

Final amount: ( 1,000 + 150 = 1,150 )

Total with Simple Interest after 3 years: $1,150

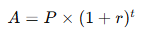

Compound Interest

With it, interest is calculated on the accumulated balance each year.

Formula:

Where:

A is the final amount.

Calculation:

- Year 1: ( 1,000 x (1 + 0.05) = 1,050 )

- Year 2: ( 1,050 x (1 + 0.05) = 1,102.50 )

- Year 3: ( 1,102.50 x (1 + 0.05) = 1,157.63 )

Total after 3 years: $1,157.63

Difference Summary:

Simple Interest: $1,150

Compound Interest: $1,157.63

With compound interest, the amount grows slightly more each year because you earn interest on accumulated interest, while simple interest is always calculated only on the initial amount.

Benefits of Compound Interest

It is incredibly important, as it creates exponential, not linear, growth. Over time, your money appreciates significantly, yielding high returns.

Why Time Is Essential

While compound interest can yield high returns, one factor is crucial: time. You can’t expect your money to double in just a few months.

With compound interest, time should be viewed as an ally. The longer your money remains invested, the more you can earn.

How it Can Harm You

Returning to the quote at the beginning, “Compound interest is the eighth wonder of the world. Those who understand it, earn it; those who don’t, pay it,” you may wonder how it could harm you.

It’s simple. In investments, they are your ally. However, it also appears in other areas.

Did you know that credit cards have high compound interest rates on unpaid balances? These rates are around 20% annually. This means if you owe $1,000 on your credit card, at the end of the year, your debt would be $1,200. It’s essential to keep your payments on time.

Summarizing

Understanding and using it to your advantage is a crucial step toward financial health. Through this foundational concept, you can learn how to make your money work for you.